U.S. implements stricter controls on nuclear exports to China

- August 19, 2023

- Posted by: Quatro Strategies

- Categories: China, Sanctions & Regulation, United States

The Biden administration has implemented stricter controls on the export of materials and components for nuclear power plants to China, aiming to ensure that these items are used solely for peaceful purposes and not for the proliferation of nuclear weapons.

Under the new regulations, exporters will need specific licenses to export certain generators, containers, software, and nuclear materials intended for use in China’s nuclear plants. The Nuclear Regulatory Commission (NRC) will require licenses for the export of special nuclear materials and source materials, which include different types of uranium and deuterium, a hydrogen isotope.

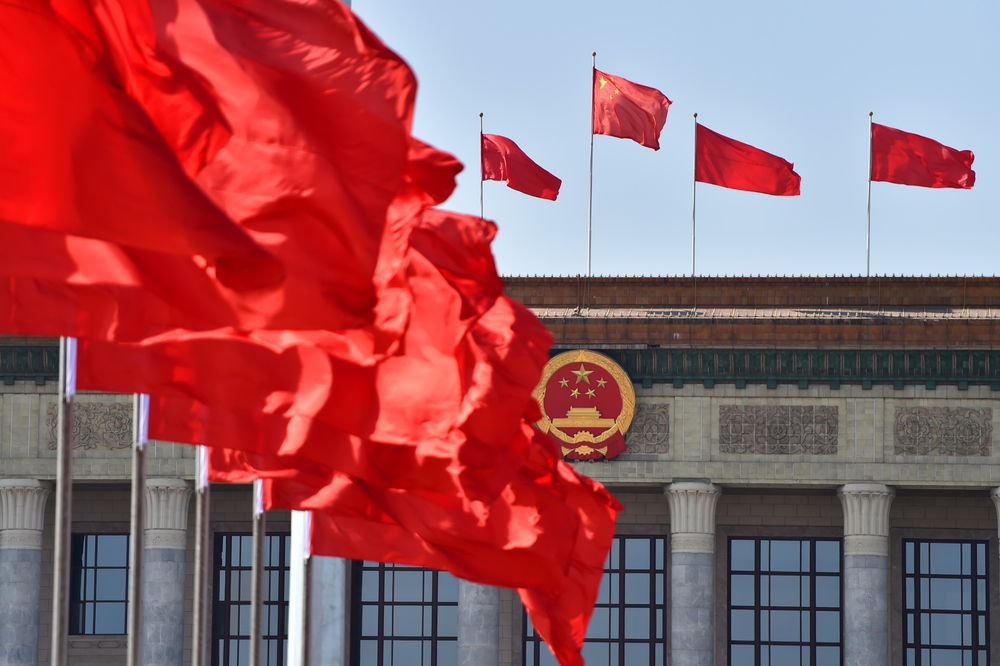

The move is a reflection of broader strained relations between the United States and China, which have been at odds over issues such as espionage, human rights, industrial policies, and the export of advanced technologies.

The NRC stated that these measures are necessary to serve the national security interests of the United States and to strengthen defense and security. However, few exporters have used a general license to export these materials to China in the past.

Chinese embassy spokesman Liu Pengyu reiterated China’s commitment to upholding the international non-proliferation regime and adhering to the Treaty on the Non-Proliferation of Nuclear Weapons. He also expressed China’s opposition to placing geopolitical interests above nuclear non-proliferation efforts.

Some analysts view these changes as symbolic rather than substantive. The impact on China’s nuclear weapons program is considered minimal, but the regulations could reflect a more cautious approach by the US administration to the potential risks of nuclear weapons development.

The implementation of these regulations could also have implications for companies involved in nuclear cooperation with China. For instance, US company Westinghouse, which has supplied reactors to China, might need to navigate these new requirements.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.