Philippines looking to back mining industry to explore more critical mineral resources

- September 20, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, Mining & Metals, Rare Earths & Commodities

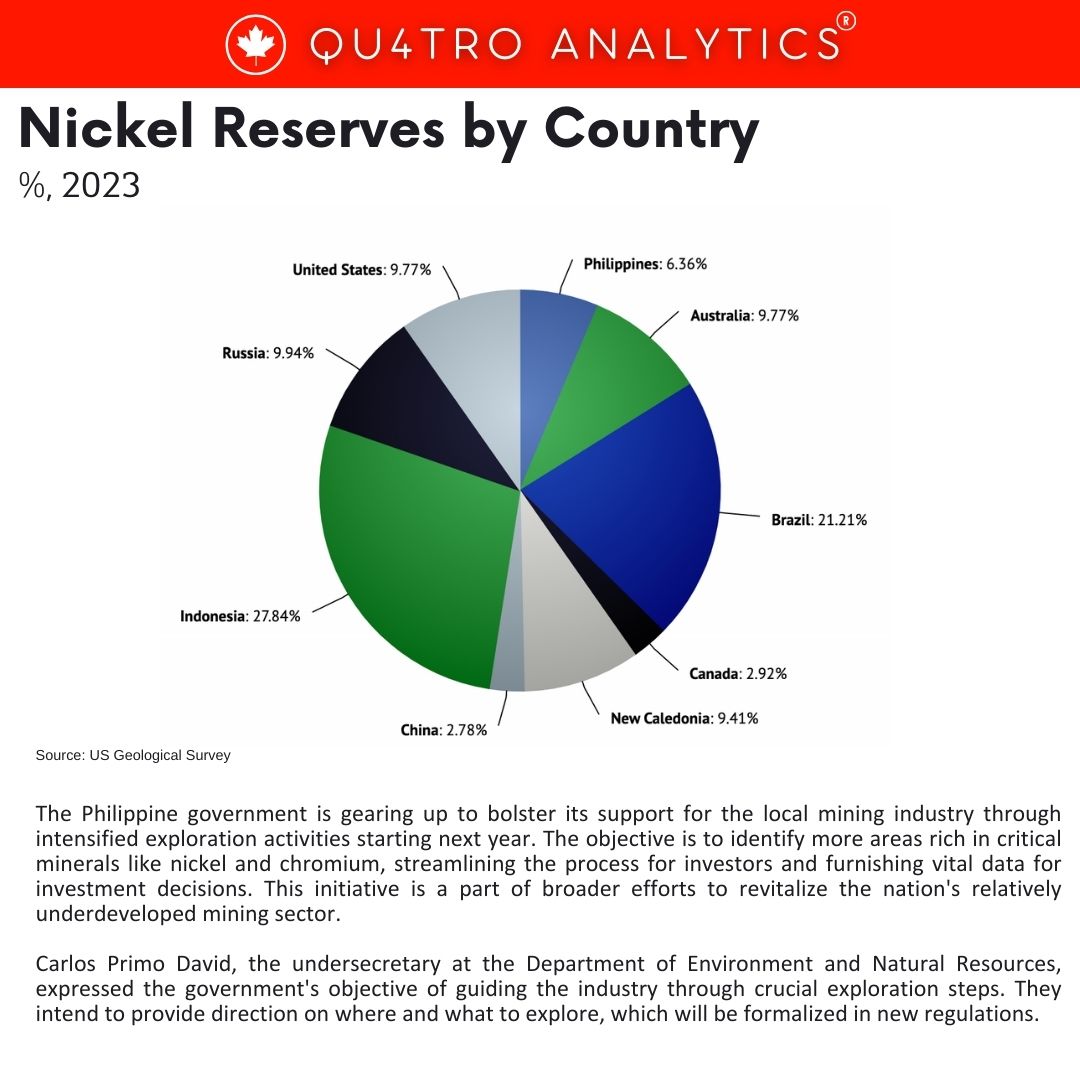

The Philippine government is gearing up to bolster its support for the local mining industry through intensified exploration activities starting next year. The objective is to identify more areas rich in critical minerals like nickel and chromium, streamlining the process for investors and furnishing vital data for investment decisions. This initiative is a part of broader efforts to revitalize the nation’s relatively underdeveloped mining sector.

Carlos Primo David, the undersecretary at the Department of Environment and Natural Resources, expressed the government’s objective of guiding the industry through crucial exploration steps. They intend to provide direction on where and what to explore, which will be formalized in new regulations.

The Philippines, a significant supplier of nickel ore to China and producer of other minerals such as copper and gold, is actively seeking increased investments in its mining sector to fuel economic growth. The government has been progressively removing restrictive mining policies, like the ban on open-pit mining, to attract investment into its domestic nickel processing sector, aiming to extract more value from its metals and minerals industry.

The Philippines, a significant supplier of nickel ore to China and producer of other minerals such as copper and gold, is actively seeking increased investments in its mining sector to fuel economic growth. The government has been progressively removing restrictive mining policies, like the ban on open-pit mining, to attract investment into its domestic nickel processing sector, aiming to extract more value from its metals and minerals industry.

The strategy includes identifying mineralized areas to declare them as mineral reservations, allowing for extra royalties for the government from mining developments in these areas.

Furthermore, the government is focusing on domestic nickel ore processing, with plans to add at least one more processing facility before President Ferdinand Marcos Jr.’s term ends in 2028. Presently, there are only two nickel ore processing facilities in the country, both partially owned by Nickel Asia Corp, the top nickel ore producer and exporter in the Philippines.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.