Offshore wind developers want the U.S. to ease subsidy requirements

- September 7, 2023

- Posted by: Quatro Strategies

- Categories: ESG & Renewable Energy, Sanctions & Regulation, United States

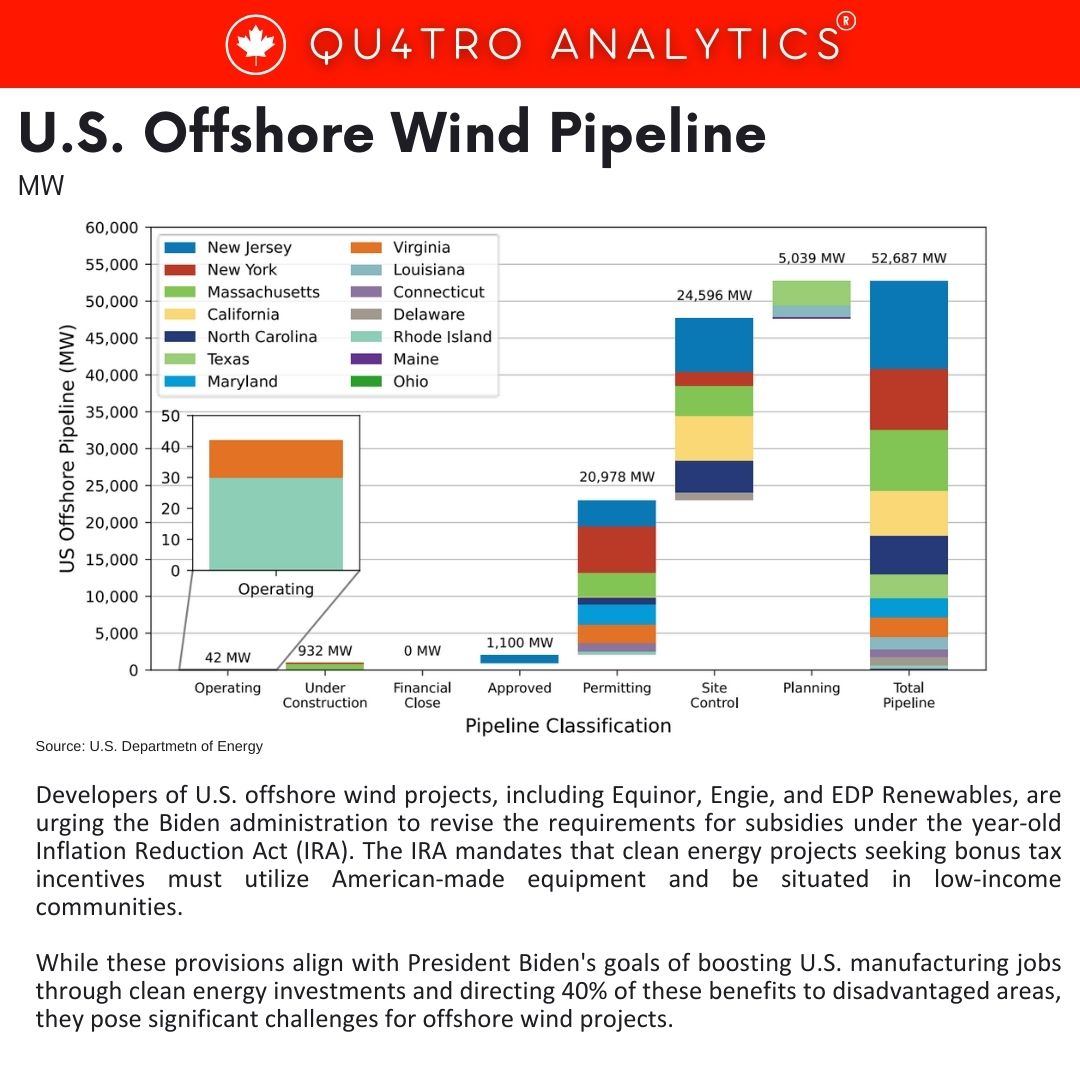

Developers of U.S. offshore wind projects, including Equinor, Engie, and EDP Renewables, are urging the Biden administration to revise the requirements for subsidies under the year-old Inflation Reduction Act (IRA). The IRA mandates that clean energy projects seeking bonus tax incentives must utilize American-made equipment and be situated in low-income communities.

While these provisions align with President Biden’s goals of boosting U.S. manufacturing jobs through clean energy investments and directing 40% of these benefits to disadvantaged areas, they pose significant challenges for offshore wind projects.

The primary issue is that the offshore wind sector heavily relies on foreign equipment and materials, and offshore installations are located in U.S. coastal waters. The IRA’s strict domestic content requirements, such as the mandate that offshore turbine towers must be made entirely of domestic steel, are difficult for the industry to meet. Furthermore, the first factory that could produce such components in the U.S., located in New York, is facing delays and cost overruns, making it impossible for developers to comply with the IRA’s demands.

The offshore wind industry already has more lenient requirements for claiming the bonus compared to other sectors, with domestic content accounting for just 20% of costs, as opposed to 40% for solar and onshore wind, according to Treasury rules. Developers are requesting more flexibility regarding the location of the domestic content and are advocating for the consideration of port infrastructure locations that can provide jobs and economic benefits to a broader area.

The offshore wind industry already has more lenient requirements for claiming the bonus compared to other sectors, with domestic content accounting for just 20% of costs, as opposed to 40% for solar and onshore wind, according to Treasury rules. Developers are requesting more flexibility regarding the location of the domestic content and are advocating for the consideration of port infrastructure locations that can provide jobs and economic benefits to a broader area.

Despite these challenges, the U.S. Treasury is determined to implement the IRA’s subsidies in a manner that aligns with the law’s goals. It asserts that the IRA has already spurred billions of dollars in new investments and emphasizes that its approach aims to incentivize investment in a U.S. clean energy supply chain over time.

Labor unions, a crucial constituency for President Biden, have been advocating for stringent requirements for the domestic content bonus. The White House has stated its commitment to advancing American offshore wind opportunities, highlighting the industry’s role in creating thousands of union jobs in manufacturing, shipbuilding, and construction.

While the offshore wind industry acknowledges the importance of the domestic content requirements for the IRA, it argues that some adjustments are necessary to facilitate the projects’ development. These adjustments are not only vital for the success of individual projects but also for the growth of the domestic offshore wind industry and the jobs it can create. Developers believe that striking the right balance is crucial to avoid hindering the industry’s expansion and the attainment of clean energy goals.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.