Mexican copper smelter project to benefit from US-China tensions

- September 28, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Business & Politics, Mining & Metals, United States

The escalating tensions between the United States and China are giving a significant boost to Southern Copper Corp.’s proposed Mexican copper smelter project. The US is striving to reduce its reliance on geopolitical rivals in its supply chain and is increasingly looking to source imports closer to home. This shift could lead to more finished copper being absorbed by manufacturers in Mexico, according to Raul Jacob, Chief Financial Officer of Southern Copper Corp.

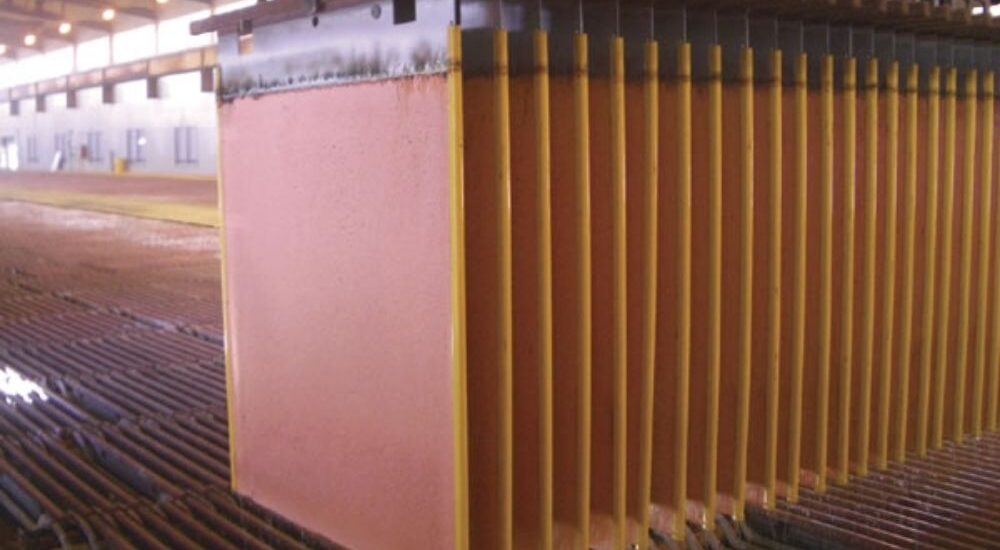

Presently, the company’s mines in Mexico produce more semi-processed copper, known as concentrate, than its existing plants can handle. The surplus concentrate is shipped to smelters offshore. Southern Copper Corp. is considering investing over $1 billion in a new smelter in Empalme, Sonora state, Mexico. This move comes in anticipation of a favorable market for buying concentrate, especially with alternative ways to obtain refined copper beyond sending it to China.

Mexico has recently surpassed China as the leading supplier of goods to the US, and the dynamics of global trade, especially in metals critical to the transition away from fossil fuels, are evolving due to US-China tensions. Besides the Mexican smelting investment, Southern Copper Corp. is considering a similar-sized smelting investment in Peru to serve its mines there, identifying Japanese technology that is more efficient than its current operations.

However, moving forward with these smelter projects necessitates greater clarity in the company’s mining-expansion plans as it aims to significantly ramp up copper output. The goal is to increase copper output from 932,000 metric tons this year to about 1.6 million tons by 2032. The new smelters are estimated to begin operating in 2029, each with a capacity of 1 million tons.

Several mineral-rich countries, including Indonesia and Chile, are looking to expand their processing capacity to reduce their dependence on Chinese smelters and minimize waste involved in exporting concentrates. However, it’s expected that the real bottleneck in copper, as demand surges due to electrification, will be at the mining stage rather than in processing.

Despite this, Southern Copper Corp.’s existing plants are yielding good returns, and selling more refined metal directly to manufacturers presents strategic benefits. Jacob emphasized that selling concentrate involves intermediaries like smelters and traders, which may not always be the optimal approach.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.