Italy’s Eni starts oil and gas production off Ivory Coast

- August 29, 2023

- Posted by: Quatro Strategies

- Categories: Africa, Oil & Gas

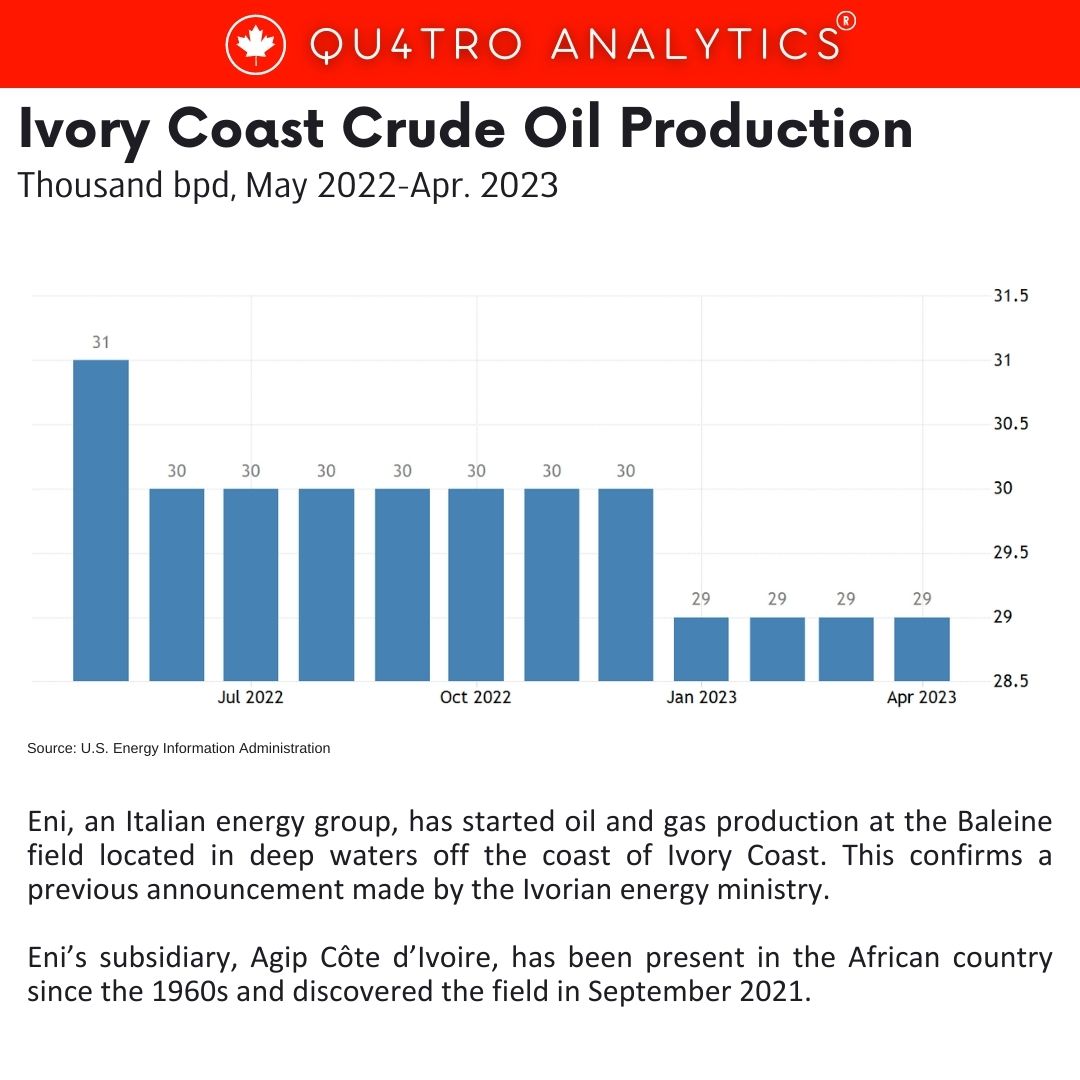

Eni, an Italian energy group, has started oil and gas production at the Baleine field located in deep waters off the coast of Ivory Coast. This confirms a previous announcement made by the Ivorian energy ministry. Eni’s subsidiary, Agip Côte d’Ivoire, has been present in the African country since the 1960s and discovered the field in September 2021.

Eni CEO Claudio Descalzi stated that the first oil from Baleine is a significant milestone for the company. They have achieved an industry-leading time-to-market of less than two years from the declaration of commercial discovery.

During the initial phase, production will occur through a production storage and offloading vessel that can handle up to 15,000 bbl/d of oil and around 25 Mscf/d of associated gas. The second phase is expected to begin by the end of 2024 and will increase field production to 50,000 bbl/d of oil and approximately 70 Mscf/d of associated gas. The third development phase aims to increase field production to 150,000 bbl/d of oil and 200 Mscf/d of gas.

During the initial phase, production will occur through a production storage and offloading vessel that can handle up to 15,000 bbl/d of oil and around 25 Mscf/d of associated gas. The second phase is expected to begin by the end of 2024 and will increase field production to 50,000 bbl/d of oil and approximately 70 Mscf/d of associated gas. The third development phase aims to increase field production to 150,000 bbl/d of oil and 200 Mscf/d of gas.

In Ivory Coast, Eni holds interests in the CI-101 and CI-802 blocks, where the Baleine field extends, as well as in four other deep-water Ivorian blocks. Petroci Holding is a partner in all these blocks.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.