Indonesia wants to discuss critical minerals trade deal with the U.S.

- September 8, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, Mining & Metals, Rare Earths & Commodities, United States

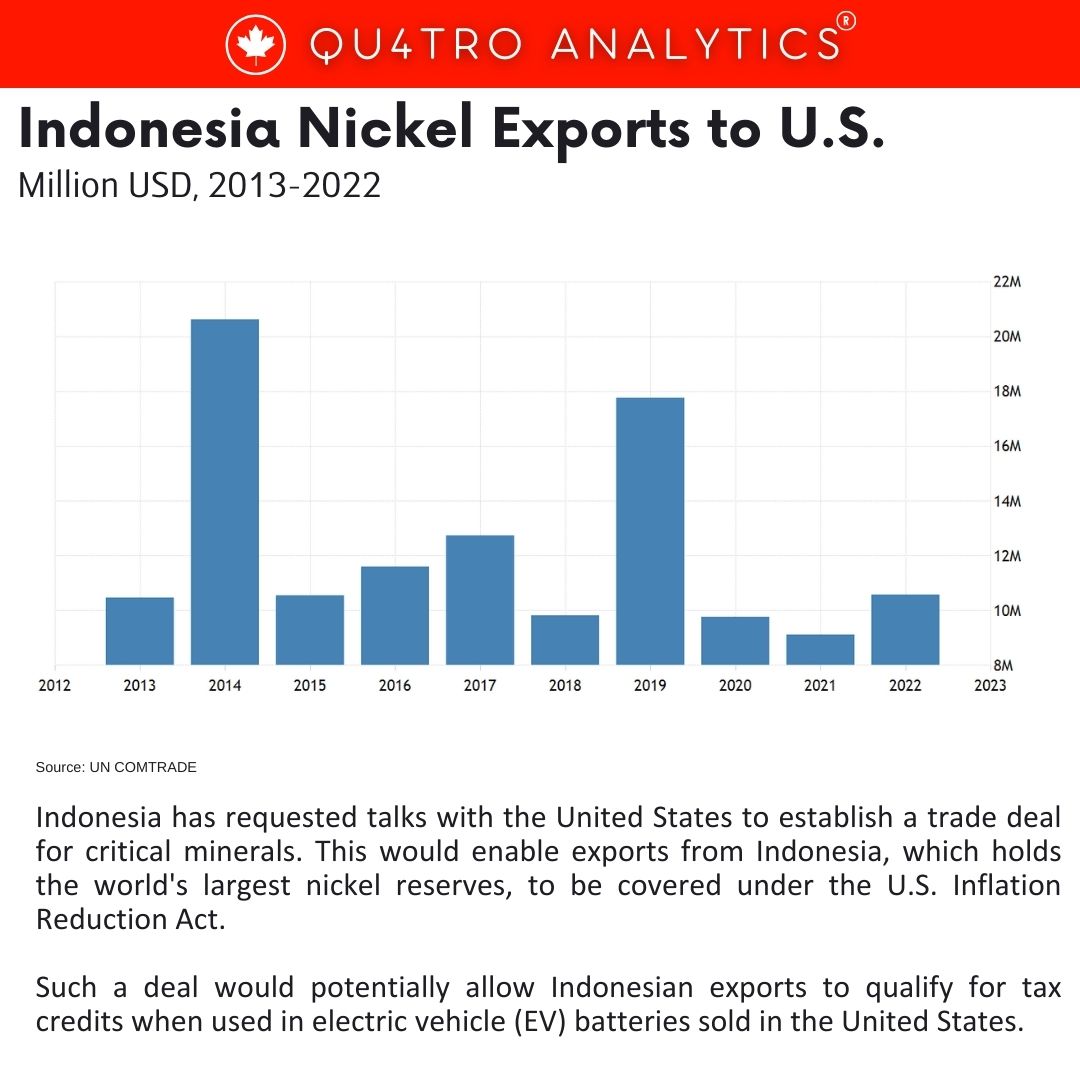

Indonesia has requested talks with the United States to establish a trade deal for critical minerals. This would enable exports from Indonesia, which holds the world’s largest nickel reserves, to be covered under the U.S. Inflation Reduction Act. Such a deal would potentially allow Indonesian exports to qualify for tax credits when used in electric vehicle (EV) batteries sold in the United States.

The request was made during a meeting between Indonesian President Joko Widodo and U.S. Vice President Kamala Harris on the sidelines of ASEAN meetings in Jakarta.

Under the U.S. Inflation Reduction Act, a certain amount of critical minerals in EV batteries must be produced or assembled in North America or a free trade partner for EVs sold in the United States to be eligible for tax credits. Indonesia lacks a free trade agreement with the United States but has ambitions to become a significant player in EV and battery manufacturing, leveraging its extensive nickel reserves.

President Jokowi noted that Indonesia can become a supplier for batteries and EVs in the U.S. due to its substantial nickel reserves. He invited the U.S. to discuss the formation of a Critical Mineral Agreement. Additionally, he expressed hope that Indonesia’s involvement in the U.S.-led Indo-Pacific Economic Framework (IPEF) could allow its mineral exports to qualify for “green subsidies” under the Inflation Reduction Act.

President Jokowi noted that Indonesia can become a supplier for batteries and EVs in the U.S. due to its substantial nickel reserves. He invited the U.S. to discuss the formation of a Critical Mineral Agreement. Additionally, he expressed hope that Indonesia’s involvement in the U.S.-led Indo-Pacific Economic Framework (IPEF) could allow its mineral exports to qualify for “green subsidies” under the Inflation Reduction Act.

The proposal for a limited free trade deal with the United States was initially brought up in April by Indonesian minister Luhut Pandjaitan. The goal is to offer the U.S. an agreement similar to the one between Japan and the U.S. for EV battery minerals.

During the meeting, Vice President Harris expressed her commitment to working with Indonesia to build supply chains that include critical minerals required for clean energy economies and to boost trade between the two countries through IPEF.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.