Gold and silver miner Polymetal decided to sell Russia assets

- September 22, 2023

- Posted by: Quatro Strategies

- Categories: Europe, Mining & Metals, Sanctions & Regulation

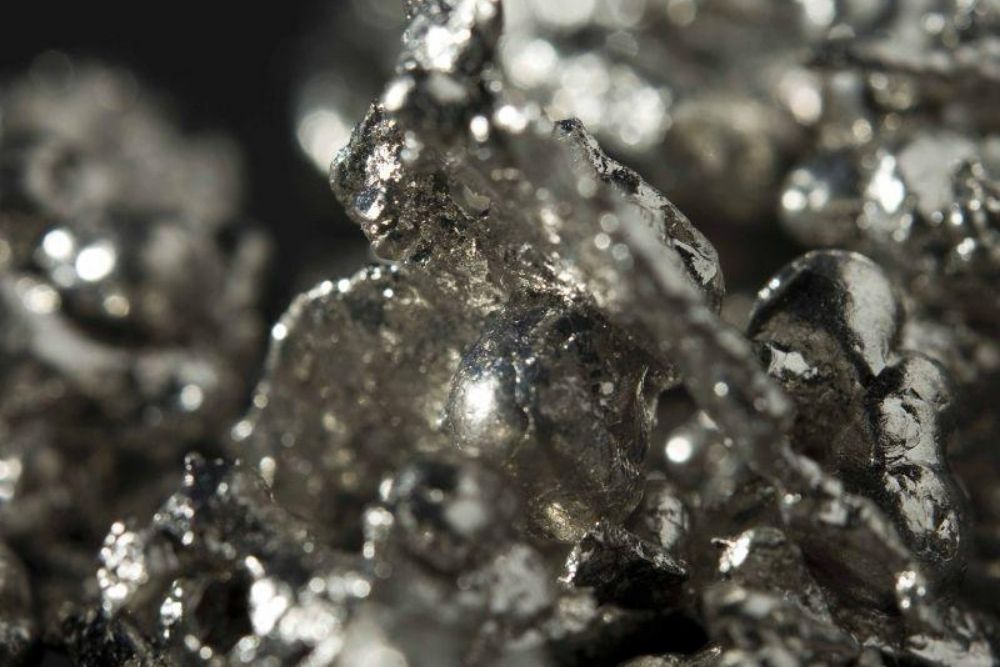

Polymetal International, a prominent gold and silver producer, has unveiled its intention to sell all of its Russian assets as a unified entity, rather than opting for a split, according to CEO Vitaly Nesis. This decision comes in the wake of sanctions imposed by the United States on Polymetal’s Russian business and Polyus, the largest gold producers in Russia, in response to Russia’s actions in Ukraine.

The move to sell the entire Russian business as a cohesive entity is aimed at preserving shareholder value, as fragmenting the assets through piecemeal sales could potentially erode value significantly.

Polymetal International had recently completed its re-domiciliation to Kazakhstan from Jersey, securing a listing on the Astana International Exchange (AIX) and committing to sell the Russian business within nine months.

Nesis addressed concerns related to Russia’s rule compelling investors from “unfriendly” jurisdictions to sell assets at half their market price, stating that this rule wouldn’t apply to Polymetal due to its redomiciliation to Kazakhstan. Additionally, he affirmed that the sale would not be to an entity on the US sanctions list, effectively ruling out Polyus as a potential buyer.

While potential buyers were not named and discussions have yet to commence, Nesis emphasized that the sale would not be a hurried process, aiming to secure a sale at a substantial value for the asset.

By QUATRO Strategies International Inc.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.