Germany’s property sector in crisis

- October 5, 2023

- Posted by: Quatro Strategies

- Categories: Business & Politics, Europe

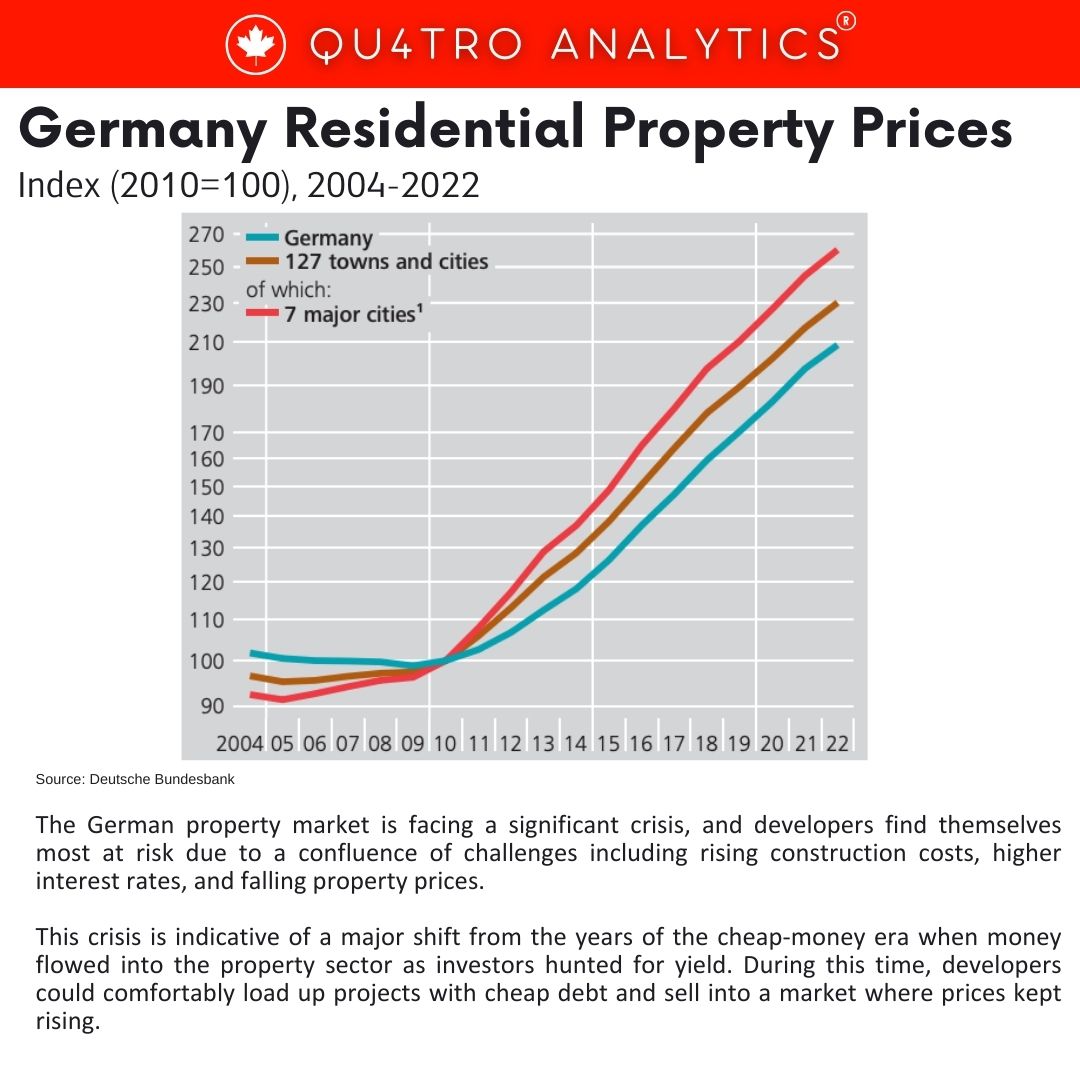

The German property market is facing a significant crisis, and developers find themselves most at risk due to a confluence of challenges including rising construction costs, higher interest rates, and falling property prices. This crisis is indicative of a major shift from the years of the cheap-money era when money flowed into the property sector as investors hunted for yield. During this time, developers could comfortably load up projects with cheap debt and sell into a market where prices kept rising.

However, the current scenario is drastically different. German real estate transactions for offices are at their lowest point on a 12-month rolling basis since at least 2014. The rapid change in fortunes is primarily attributed to a collapse in land values, making projects riskier for developers. As interest rates have surged, investors have demanded higher rental yields to compensate, pushing down the price they are willing to pay for a finished site.

Construction costs have also spiraled upwards, compelling developers to set aside more money for unexpected expenses. All these factors have depressed the underlying value of developer land, upending the economics of property development. This price drop means some companies may lose money just by finishing a building. For instance, Aggregate Holdings SA, a real estate company, had to hand over the keys of a project to a creditor due to cost overruns.

Developers like Gerch and Euroboden are particularly vulnerable because of a collapse in land values, making their projects riskier. The increasing interest rates have made investors demand higher rental yields to compensate, subsequently pushing down the price they are willing to pay for a finished site. Construction costs have also escalated, forcing developers to allocate more money for unexpected expenses.

All these factors have depressed the underlying value of developer land, upending the economics of property development. This price drop means some companies may lose money just by finishing a building. For instance, Aggregate Holdings SA, a real estate company, had to hand over the keys of a project to a creditor due to cost overruns.

All these factors have depressed the underlying value of developer land, upending the economics of property development. This price drop means some companies may lose money just by finishing a building. For instance, Aggregate Holdings SA, a real estate company, had to hand over the keys of a project to a creditor due to cost overruns.

Germany’s development boom was partly fueled by mezzanine lenders who were willing to make substantial loans to developers with little equity. However, the market correction has left developers without agreed forward sales, leaving them saddled with pricey debt and runaway costs. Developers are particularly vulnerable because of a collapse in land values, which makes projects riskier.

As interest rates have soared, investors have demanded higher rental yields to compensate, which in turn pushes down the price they’ll pay for a finished site. Construction costs are also spiraling, and developers are having to put more money aside for unexpected expenses.

The crisis in the property market extends to various parts of the world. In Australia, homebuilders like Porter Davis have gone into liquidation this year due to surging costs and falling demand. In Sweden, a rise in bankruptcies has been driven by a construction slump, while in Finland, housing starts could plunge to levels not seen since the 1940s, according to the country’s construction lobby.

These challenges faced by developers and the broader property sector have wider implications for the economy and highlight the need for structural changes and support to navigate through this crisis.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.