Exxon and partners to spend $12.93 billion for sixth Guyana offshore oil project

- August 22, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Oil & Gas

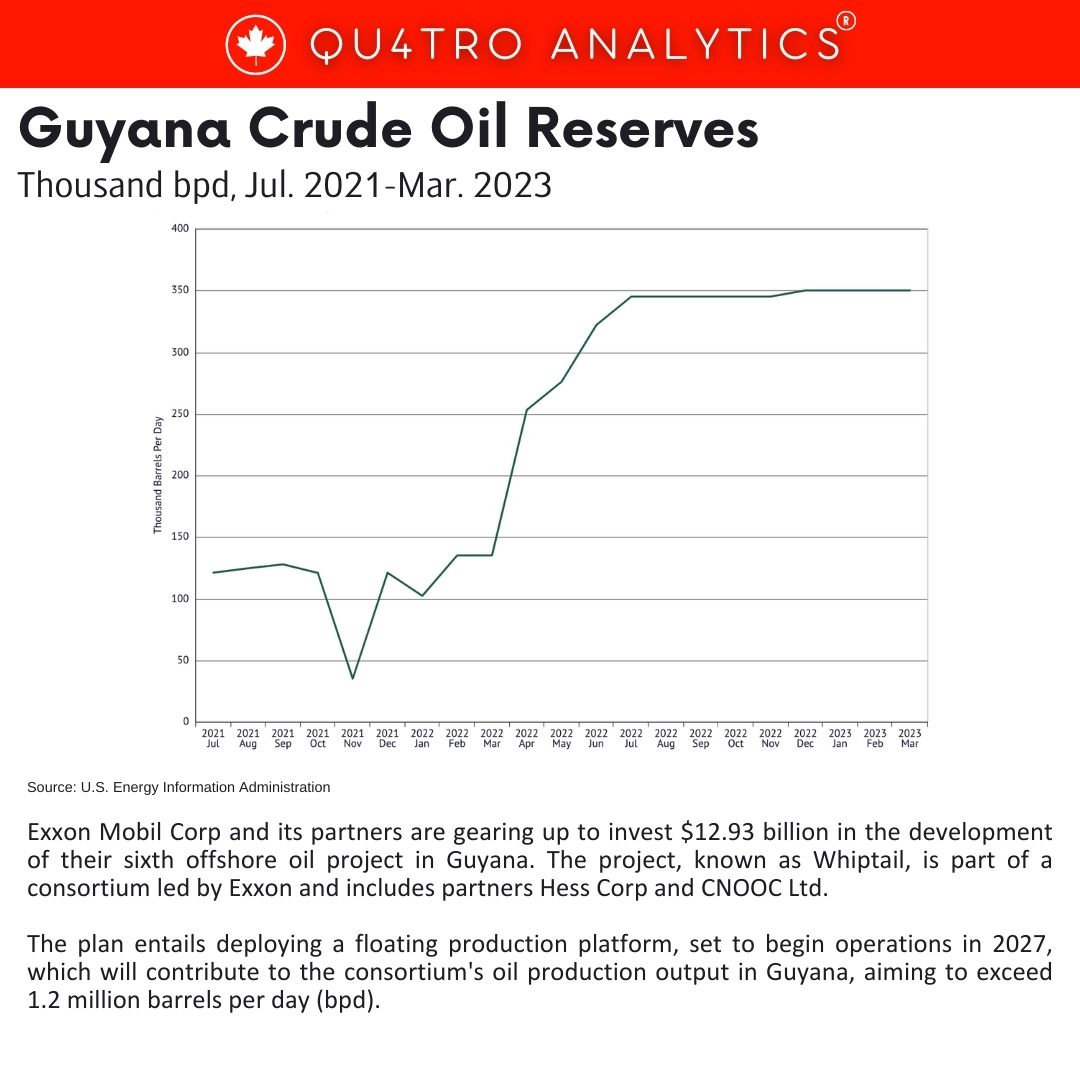

Exxon Mobil Corp and its partners are gearing up to invest $12.93 billion in the development of their sixth offshore oil project in Guyana. The project, known as Whiptail, is part of a consortium led by Exxon and includes partners Hess Corp and CNOOC Ltd. The plan entails deploying a floating production platform, set to begin operations in 2027, which will contribute to the consortium’s oil production output in Guyana, aiming to exceed 1.2 million barrels per day (bpd).

Guyana has recently emerged as a major player in the global oil industry with substantial discoveries totaling over 11 billion barrels of oil and gas. Exxon and its partners have already achieved an output of 400,000 bpd from two vessels in the region. The new Whiptail project, following the model of the Uaru project, is anticipated to add to this production capacity, contributing significantly to the country’s growing oil revenue.

Exxon, Hess, and CNOOC have committed substantial financial resources to the development of Guyana’s offshore oil sector. The investments have also led to substantial direct revenue for the country, totaling $2.8 billion, and the creation of job opportunities for thousands of Guyanese citizens.

Exxon, Hess, and CNOOC have committed substantial financial resources to the development of Guyana’s offshore oil sector. The investments have also led to substantial direct revenue for the country, totaling $2.8 billion, and the creation of job opportunities for thousands of Guyanese citizens.

Whiptail’s plan does not involve the production of natural gas due to concerns that reducing injected gas could adversely impact oil recovery. The consortium plans to drill around 72 wells and commence development drilling by late 2024, with subsea component installation beginning in the second half of 2025 or early 2026. The project is expected to generate employment opportunities for up to 540 people during the drilling and installation phase, and around 100 to 180 people during the production operations phase.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.