Chile’s public-private model attracts more than 50 lithium miners

- August 21, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Mining & Metals, Sanctions & Regulation

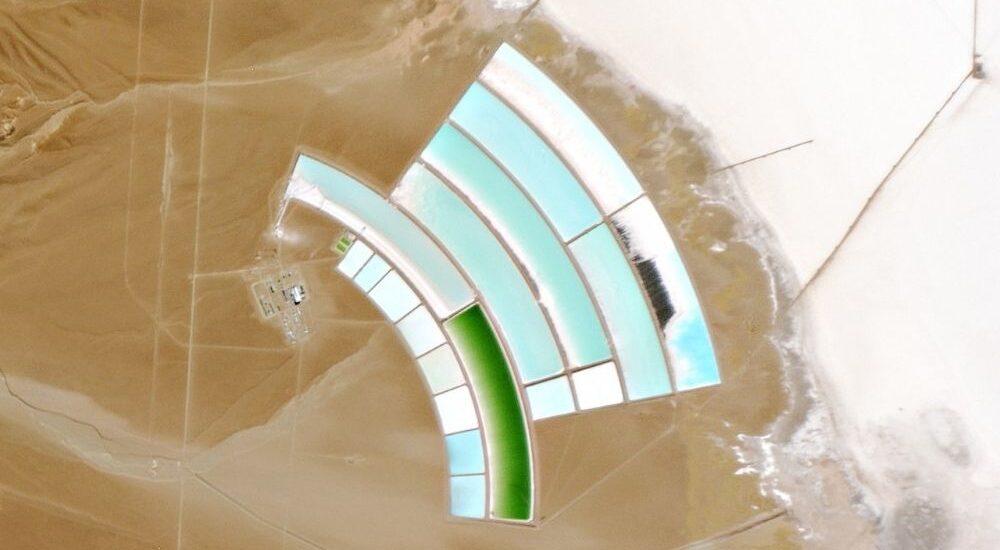

More than 50 global companies are actively pursuing lithium deals under Chile’s new public-private model for the sector. Traditionally, US-based Albemarle and Chile-based Sociedad Quimica y Minera de Chile (SQM) have dominated the Atacama salt flat, which accounts for 30% of global lithium production. The new model proposed by President Gabriel Boric involves the state having a controlling stake in strategic operations, while private firms retain control of non-strategic projects. The government also plans to negotiate with Albemarle and SQM for larger stakes in their existing contracts, overseen by state-owned copper producer Codelco.

President Boric sees Chile’s lithium reserves as a significant opportunity for economic development and sustainable growth. However, his plan requires approval from the National Congress of Chile, where he lacks a majority, meaning potential changes before approval. Boric’s government aims to establish a new national lithium company through legislation, which could take a substantial portion of his four-year term.

Under the proposed policy, private entities can participate in the lithium industry, but only as minority partners in joint ventures with the State. This approach aims to incentivize the exploration of other salt flats in addition to the Atacama, diversifying lithium sources and expanding production.

SQM, in particular, faces risks, as its contract for extracting lithium in the Atacama salt flat expires in 2030. While Boric assures that existing contracts will be respected, the balance between competing interests remains unclear.

Chile’s push for state control in key sectors reflects a broader wave of nationalization and protectionism in Latin America, exemplified by Mexico’s reforms in the energy and power sectors. While these measures aim to secure national interests, they also raise concerns about maintaining a balance between economic growth, foreign investment, and local development.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.