Brazil’s Petrobras considers establishing China subsidiary

- September 1, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Business & Politics, China, Oil & Gas

Petrobras, the state-run oil company of Brazil, is planning to establish a Chinese subsidiary as part of its efforts to strengthen its relationship with China, one of its most significant trading partners. This move is part of Petrobras’ strategy to significantly increase its share of China’s oil imports over the next couple of decades, aiming to triple its current 5% share. The CEO of Petrobras, Jean Paul Prates, mentioned that the subsidiary is expected to be created in the next year, subject to formal approval.

The creation of a Chinese subsidiary is seen as a strategic move by Petrobras to enhance its presence in China and foster closer partnerships with Chinese companies, especially in the energy sector. It’s worth noting that Petrobras has already initiated discussions with several Chinese firms, including CNOOC and Sinopec, as well as financial institutions like China Development Bank and Bank of China, to explore potential energy partnerships and joint projects.

Furthermore, the establishment of a Chinese subsidiary would provide Petrobras with a platform to operate and participate in projects as a partner, not only in China but also in other countries, including those in Africa. This approach aligns with Petrobras’ broader international expansion strategy and its goal to diversify its operations and revenue streams.

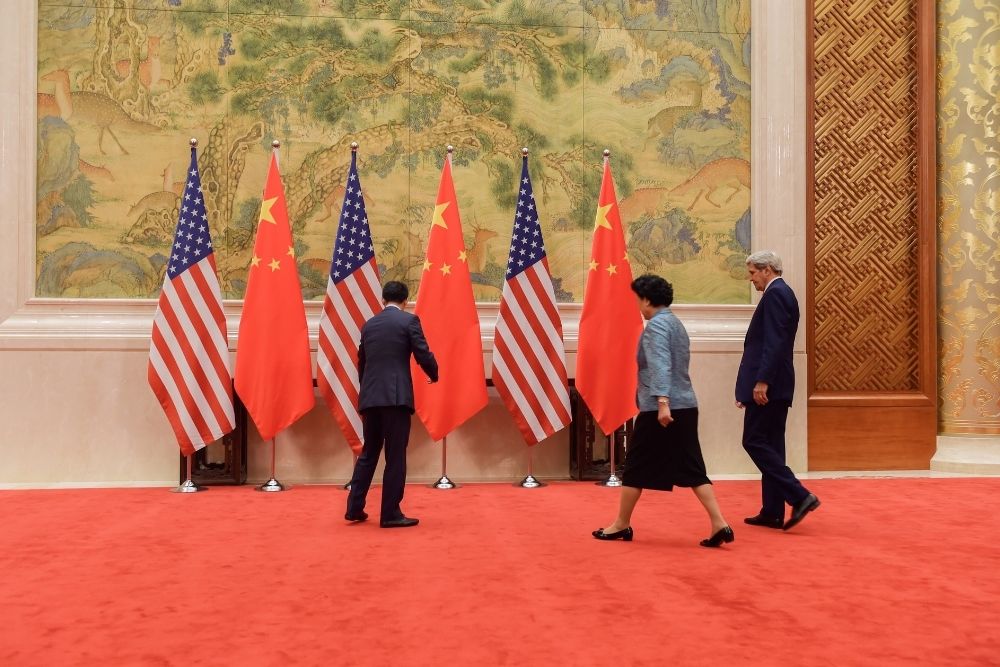

The move to create a Petrobras China subsidiary is also seen as a positive signal for strengthening Brazil-China relations under the leadership of President Luiz Inacio Lula da Silva. Unlike his predecessor, Jair Bolsonaro, President Lula has advocated for balanced and cooperative relations with both China and the United States. His administration’s approach to foreign policy emphasizes building strong partnerships with major global players, and China is a key focus due to its growing economic influence.

Overall, Petrobras’ decision to create a Chinese subsidiary reflects its commitment to expanding its footprint in China’s energy market and fostering closer cooperation between Brazil and China in various international projects, contributing to the strengthening of diplomatic ties between the two countries.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.