Brazil set to establish first energy exchange for power deals next year

- October 4, 2023

- Posted by: Quatro Strategies

- Categories: Americas, ESG & Renewable Energy, Oil & Gas

Brazil, a behemoth in both the energy and electricity markets of Latin America, is on the verge of establishing its inaugural energy exchange dedicated to power deals. This significant development is anticipated to commence operations in the upcoming year. Spearheading this venture is a collaboration between key entities: L4 Venture Builder, B3 SA Brasil Bolsa Balcao (the operator of Brazil’s stock exchange), and Nodal Exchange, a prominent part of the European Energy Exchange.

In its initial phase, N5X, as the joint venture is named, plans to introduce a pivotal service involving the registration of power purchase agreements (PPAs). These agreements will facilitate transactions within the free market, allowing power generators to engage with large industrial consumers. The launch is expected to streamline power deal transactions and provide a transparent platform for stakeholders in the energy sector.

The envisioned trajectory for N5X doesn’t stop at PPAs. Once the regulatory approvals are in place, the energy exchange aspires to expand its portfolio by venturing into electricity derivatives. This strategic move is projected to breathe fresh life into the energy-related financial products market, potentially unlocking vast opportunities within the sector.

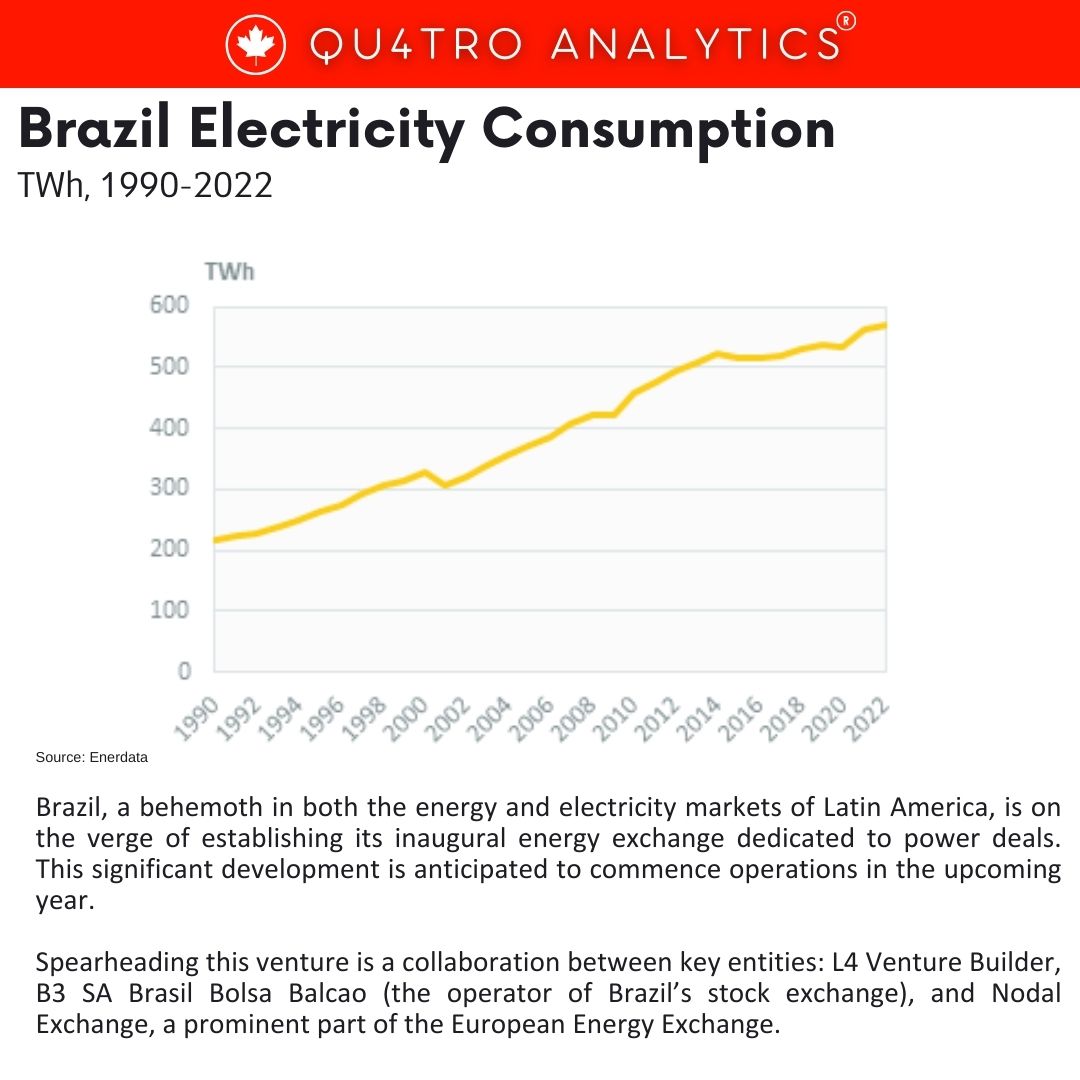

Brazil stands as a colossal power market, showcasing its dominance in the Latin American region. Furthermore, it claims the seventh position globally in terms of electricity generation capacity. In 2021, Brazil’s installed capacity soared to 181.6 GW, marking a substantial 3.9% increase from the previous year. Noteworthy growth was observed in wind power, surging by 21.2%, and solar power, which saw a remarkable spike of 40.9%.

Brazil stands as a colossal power market, showcasing its dominance in the Latin American region. Furthermore, it claims the seventh position globally in terms of electricity generation capacity. In 2021, Brazil’s installed capacity soared to 181.6 GW, marking a substantial 3.9% increase from the previous year. Noteworthy growth was observed in wind power, surging by 21.2%, and solar power, which saw a remarkable spike of 40.9%.

Investment in the Brazilian electricity sector is set to soar, with an estimated influx of $94 billion anticipated by 2029. These investments will encompass a spectrum of initiatives, spanning from utility-scale generation to distributed generation and transmission projects. This robust investment landscape underpins the country’s ambition to fortify its energy infrastructure and advance its capabilities in sustainable power sources.

Simultaneously, Brazil’s free power market is experiencing a surge in growth, attracting an increasing number of consumer units. Notably, between January and August, over 4,800 consumer units made the transition to this burgeoning market, marking the fastest pace of migrations to the free market in Brazilian history.

As it stands, the non-regulated market comprises approximately 35,540 consumers, primarily hailing from the industrial and services sectors, and contributes to around 37% of the nation’s total energy consumption. The establishment of N5X is poised to leverage this growing market, providing a pivotal platform for power transactions and fostering the nation’s energy landscape.

QUATRO Strategies International Inc. is the leading business insights and corporate strategy company based in Toronto, Ontario. Through our unique services, we counsel our clients on their key strategic issues, leveraging our deep industry expertise and using analytical rigor to help them make informed decisions to establish a competitive edge in the marketplace.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.