China’s Zijin halts acquisition activities amid high costs, geopolitical tensions

- August 31, 2023

- Posted by: Quatro Strategies

- Categories: China, Mining & Metals, Rare Earths & Commodities

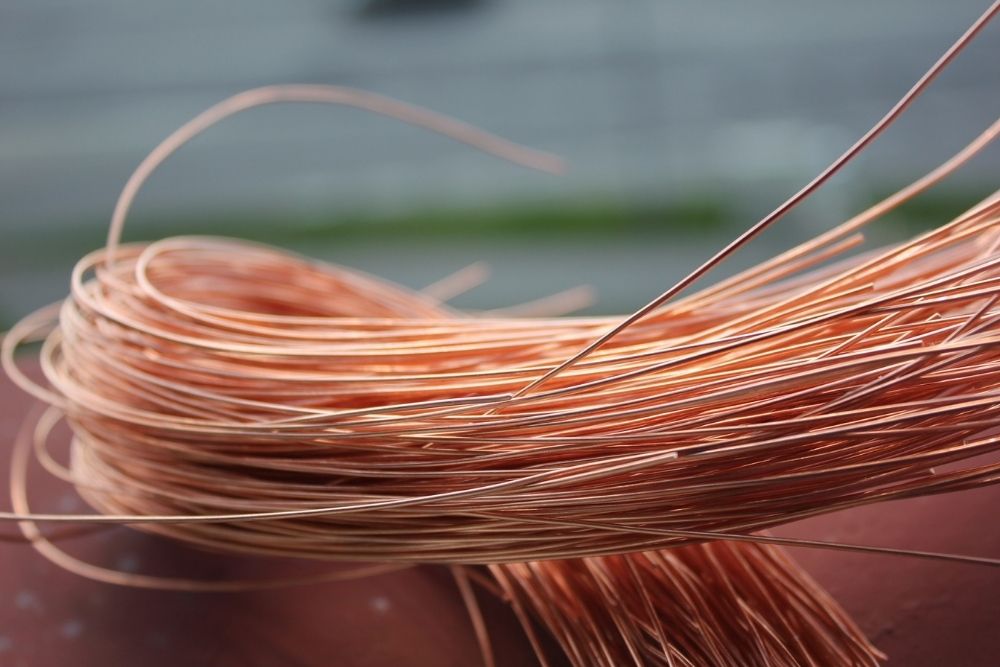

Zijin Mining Group, a prominent Chinese copper and gold mining company, has put the brakes on its acquisition activities due to factors such as high project valuations and geopolitical tensions. Although the company is still exploring merger and acquisition opportunities, its pace of deals has slowed down in comparison to previous years.

Zijin Mining has been known for its aggressive acquisition strategy, having acquired a series of copper and gold mines globally to support its ambitious production goals. Additionally, the company has expanded into the lithium sector to establish a presence in the battery metals market for electric vehicles.

The company’s current approach reflects the challenges it faces, including intense competition for projects and elevated project premiums. This, combined with relatively high metals prices, has prompted Zijin Mining to exercise greater caution in its acquisitions.

Given the existing geopolitical and economic landscape, Zijin Mining intends to increase its investments within China and neighboring countries. The company aims to focus on significant projects that could have a substantial impact on its overall performance. Zijin Mining’s emphasis will remain on gold, copper, zinc, and new energy minerals.

While lithium prices have experienced a significant decline recently, Zijin Mining remains optimistic. The company’s lithium projects are still profitable even in the face of such price fluctuations, and its overall strategy seems to account for potential market volatility.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.