Rio Tinto, First Quantum make JV agreement for Peru copper mine

- August 30, 2023

- Posted by: Quatro Strategies

- Categories: Americas, Mining & Metals, Rare Earths & Commodities

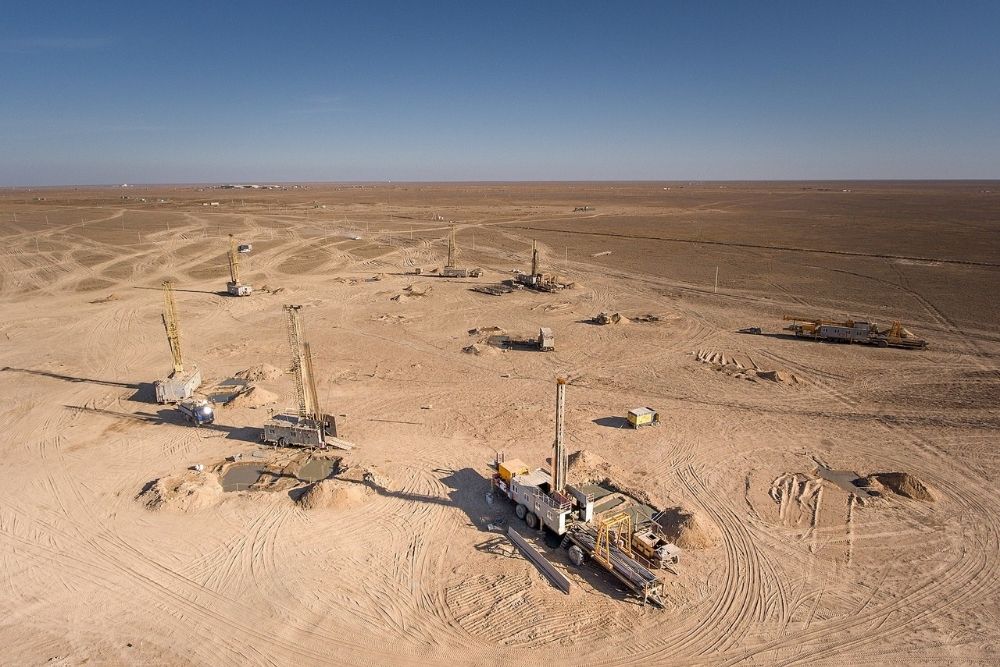

Mining giants Rio Tinto and First Quantum Minerals have entered into a joint venture to develop the La Granja copper project in Peru. First Quantum has acquired a 55% stake in the project by paying $105 million to Rio Tinto and will be the operator. As part of the deal, First Quantum has committed to investing up to $546 million into the project, with a portion of the funds allocated to completing a feasibility study over the next two to three years. La Granja is considered one of the world’s largest undeveloped copper deposits, with significant potential for expansion.

Located at an altitude of 2,000 to 2,800 meters in northern Peru’s Cajamara province, the La Granja project is a complex undertaking. Previous reserve estimates indicate significant copper resources, with 4.32 billion tonnes of indicated and inferred mineral resources at a grade of 0.51% copper. The development of La Granja aligns with the growing demand for copper as the world transitions to a greener economy and increases its reliance on clean energy technologies.

Tristan Pascall, CEO of First Quantum, highlighted the project’s potential to be a large, long-life operation that could contribute to the global supply of copper for the energy transition. Rio Tinto’s Copper Division CEO, Bold Baatar, echoed this sentiment, emphasizing that La Granja’s development would further strengthen Rio Tinto’s materials portfolio for the energy transition.

Rio Tinto originally acquired the La Granja Project from the Peruvian government in 2006 and subsequently conducted extensive drilling to expand the understanding of the orebody. The joint venture signifies a strategic move for both companies to tap into the growing demand for copper in the context of global efforts to reduce carbon emissions and promote sustainable technologies.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.