Southeast Asia renewable investments to exceed $76 billion between 2023 and 2025

- August 22, 2023

- Posted by: Quatro Strategies

- Categories: Asia Pacific, ESG & Renewable Energy

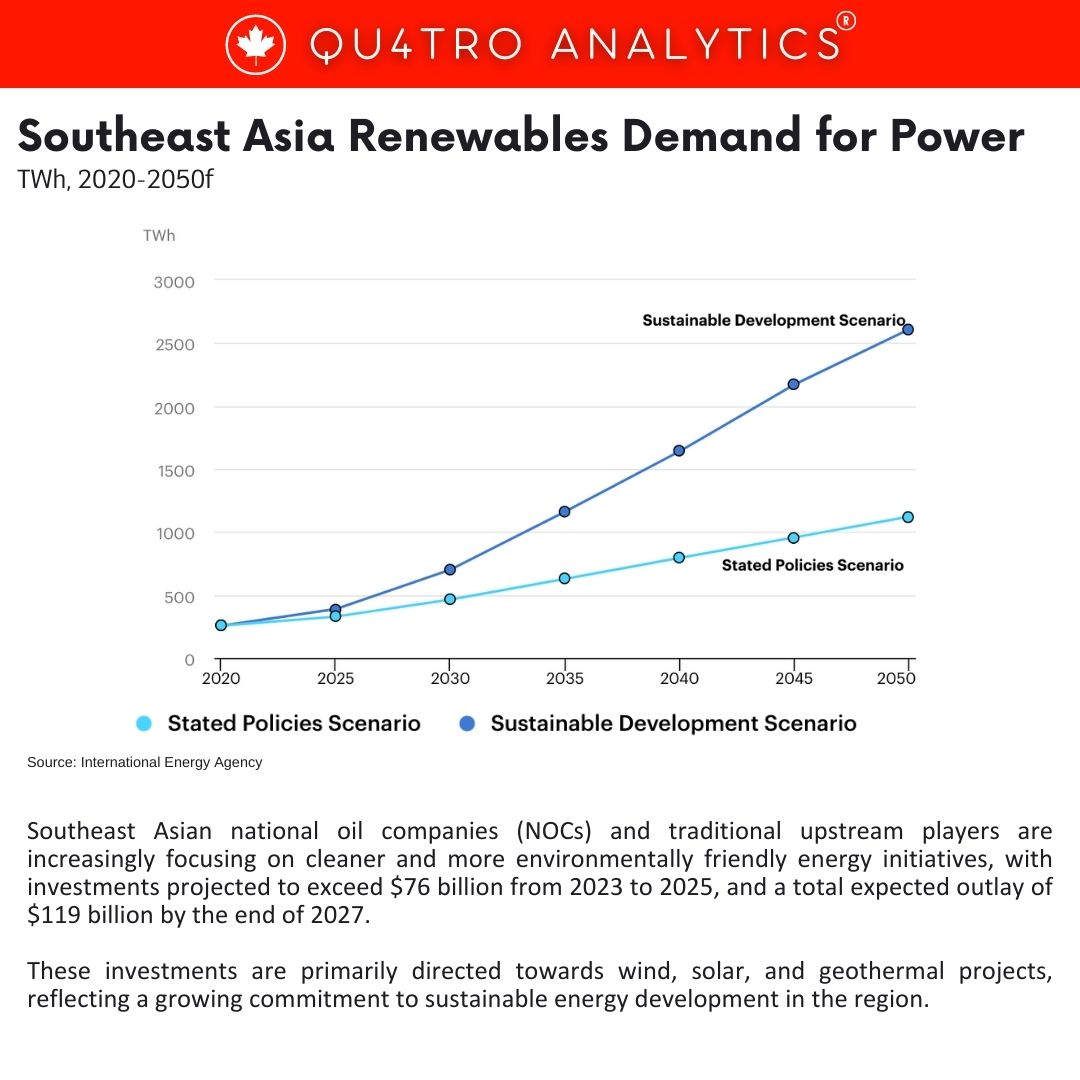

Southeast Asian national oil companies (NOCs) and traditional upstream players are increasingly focusing on cleaner and more environmentally friendly energy initiatives, with investments projected to exceed $76 billion from 2023 to 2025, and a total expected outlay of $119 billion by the end of 2027. These investments are primarily directed towards wind, solar, and geothermal projects, reflecting a growing commitment to sustainable energy development in the region.

Countries like Indonesia and Malaysia are leading the charge in this transition. Indonesia’s Pertamina is expanding its participation in geothermal projects, while Malaysia’s Petronas is actively pursuing a presence in the carbon capture, utilization, and storage (CCUS) market. Petronas has announced plans to build the world’s largest dedicated CCUS facility, capable of capturing and storing 3.3 million tonnes of carbon dioxide annually.

Gentari, a subsidiary of Petronas, is also investing significantly in solar capabilities to tap into the renewable energy potential of the nation. While Southeast Asia has historically lagged in clean energy development, collaboration between the public and private sectors is becoming crucial for sustainable growth.

Pertamina Geothermal Energy (PGE), a subsidiary of the Indonesian NOC, is a leader in low-carbon expenditure. PGE’s investments of around $1.6 billion between 2023 and 2026 are contributing to Indonesia’s geothermal capacity expansion. Petronas is collaborating with international operators to explore decarbonization solutions and is focusing on the Kasawari CCUS project.

Pertamina Geothermal Energy (PGE), a subsidiary of the Indonesian NOC, is a leader in low-carbon expenditure. PGE’s investments of around $1.6 billion between 2023 and 2026 are contributing to Indonesia’s geothermal capacity expansion. Petronas is collaborating with international operators to explore decarbonization solutions and is focusing on the Kasawari CCUS project.

Global energy majors like Shell and ExxonMobil are showing interest in Southeast Asian low-carbon opportunities, although their current investments are primarily directed at Europe and North America. Petronas is set to spend $450 million on CCUS projects and $330 million on hydrogen developments between 2023 and 2026. Vietnamese NOC PetroVietnam is partnering with Danish company Orsted and T&T Group for the country’s first offshore wind projects.

Oil and gas service companies are adopting a dual strategy, capitalizing on current demand in the sector while preparing for low-carbon expansion. Southeast Asian governments and financial institutions are providing incentives, encouraging service companies to participate in renewable energy ventures. As the region aims to achieve a renewable energy share of 30% by 2040, local service companies are joining the effort, with operators playing a role in supporting their transition to low-carbon sectors.

Different countries in Southeast Asia are propelling the region’s energy transition efforts, leveraging unique advantages. Vietnam, the Philippines, and Indonesia are expected to become dominant forces in the low-carbon landscape. These countries are setting ambitious goals to reduce reliance on fossil fuels, increase renewable energy capacity, and attract foreign investments to support their sustainable energy ambitions.

Interested in learning more?

Sign up for Top Insights Today

Top Insights Today delivers the latest insights straight to your inbox.

You will get daily industry insights on

Oil & Gas, Rare Earths & Commodities, Mining & Metals, EVs & Battery Technology, ESG & Renewable Energy, AI & Semiconductors, Aerospace & Defense, Sanctions & Regulation, Business & Politics.